Over the past few years, the combination of low home prices and falling mortgage rates led to historic levels of housing affordability. Buyers were able to afford more for their money, which along with an improving economy, led to a rebound in the housing market. This year saw increases in prices, rates, and sales, all of which indicated that housing was in the midst of a sustained and continuing recovery. But that market recovery also impacted affordability levels. Affordability has been slowly declining as mortgage rates and home values increased. But, according to Svenja Gudell, director of economic research at Zillow, housing affordability is still much higher than historical levels as compared to an average from 1985 to 2000. Gudell says recent fluctuations in the housing market are normal adjustments and part of the process of home prices returning to more sustainable levels. More here.

Tag Archive for mortgage rates

Report Finds More Evidence of Cooling Price Increases

Home prices rose rapidly through the first half of the year, signaling a rebound and a healthier housing market. But now there is increasing evidence that home prices may be cooling off. According to Trulia’s Price Monitor, asking prices were up 3 percent quarter-over-quarter in September, the smallest gain since February. Jed Kolko, Trulia’s chief economist, said asking prices are the first indicator of where home sale prices are headed and they point to a slowdown. According to Kolko, two thirds of the largest metropolitan areas are experiencing cooling prices and 11 of the 100 largest cities are actually seeing prices begin to slip. Rising mortgage rates, expanding inventory, and less investor activity are among the reasons for the slowing price increases, Kolko said. Year-over-year, home prices were up 11.5 percent, but that number is expected to shrink in coming months. More here.

Mortgage Rates Fall To Lowest Level Since June

According to the Mortgage Bankers Association’s Weekly Applications Survey, the average contract interest rate for 30-year fixed-rate mortgages fell again last week. Mortgage rates are now at their lowest point since June. Despite the drop in rates, however, demand for mortgage loans overall was down 0.4 percent, due to a 6 percent slide in the seasonally adjusted Purchase Index. The Refinance Index, on the other hand, saw a 3 percent uptick due to consecutive weeks of declining mortgage rates. The increase brought the refinance share of total mortgage activity up to 63 percent. According to the report, all fixed-rate mortgages fell to three-month lows last week. More here.

Buying A Home Still Cheaper Than Renting

Despite recent increases in home prices and mortgage rates, buying a home is still cheaper than renting, according to Trulia’s Summer 2013 Rent Vs. Buy Report. The report, which compared the average cost of renting and owning a home in America’s 100 largest metropolitan areas between June 1 and August 31, found homeownership is now 35 percent cheaper than renting. That’s down from last year when buying a home was 45 percent cheaper. Jed Kolko, Trulia’s chief economist, said, though rising mortgage rates and home prices have made buying less affordable than last year, they’re both still below historical norms. According to Kolko, mortgage rates would have to reach into double-digits before renting became cheaper than buying. The report found that homeownership was more affordable than renting in all of the largest 100 cities surveyed. San Jose, San Francisco, Honolulu, Orange County, and New York were the metros where the associated costs between renting and buying were closest. More here.

Continuation Of Fed Program Alters Rate Forecast

Federal efforts to support the ailing economy and strengthen the housing market began in 2009. The effects of these efforts have kept mortgage rates down and housing affordability high, resulting in a rebounding market and increasingly healthy economy. Because of this, expectations that the Federal Reserve would begin winding down its bond-buying program, have led to an increase in mortgage rates and forecasts of a coming economic slowdown. But, despite indicating the program would be cut back by the end of this year, the Fed recently announced it would continue the program and insisted there is no preset course or schedule for ending the purchases. Analysts expect that the continuation of the program will result in a break from the increases in mortgage rates seen over the past few months. More here and here.

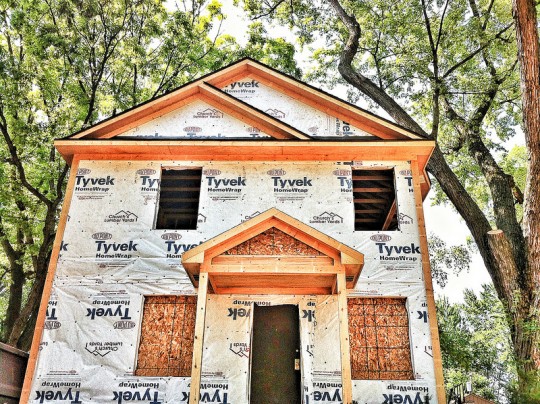

Builders Confident In Market For New Homes

When it comes to gauging the health of the market for newly built homes, professional builders offer an unique perspective. Because of this, the National Association of Home Builders conducts a monthly survey to determine the level of confidence home builders have in the market. The survey, conducted for the past 25 years, scores builders’ confidence so that any number above 50 indicates more builders view conditions as good than poor. In September, the Index was unchanged from the previous month at 58. September’s reading follows four consecutive months of gains. Rick Judson, NAHB’s chairman, said confidence is holding at the highest level in nearly eight years but buyers are beginning to express more hesitancy due to recent increases in mortgage rates. Despite the increases, however, interest rates are still quite low based on historical norms, Judson said. More here.

Majority of Americans Say Now Is A Good Time To Buy

Fannie Mae’s National Housing Survey polls Americans each month to assess their perception of the housing market, including attitudes toward owning or renting a home, price and rate changes, consumer confidence, household finances, and the overall economy. According to the results of the most recent survey, Americans’ optimism about housing growth has begun to plateau after trending upward since the beginning of the year. Still, a majority of respondents say now is a good time to buy a home and the number who said they’d prefer to buy if they had to move increased from last month. The percentage of people who believe it’d be easy for them to get a home mortgage also increased from the previous month’s survey. Overall, participants said they think home prices and rent will rise over the next year, while the number of people who said mortgage rates would increase over the same time period fell slightly from the month before. More here.