The Mortgage Bankers Association’s monthly Mortgage Credit Availability Index measures how easy or difficult it is for borrowers to access credit. Any increase in the index indicates loosening credit while declines are a sign that credit is becoming tighter. There are a number of factors that affect whether availability has loosened or tightened, including current lending standards and available loan programs. In July, the MCAI was mostly flat, falling just 0.3 percent from the month before. Joel Kan, MBA’s vice president and deputy chief economist, says the decline was mostly due to fewer cash-out refi programs. “One key driver of this month’s decline was a drop in cash-out refinance loan programs,” Kan said. “The 30-year fixed mortgage rate averaged … more than a percentage point higher than July 2022, and this has significantly discouraged cash-out refinance activity, as borrowers turn to home equity and consumer loans instead.” Kan also noted a decline in the number of loan programs offered by jumbo lenders. (source)

Archive for August 2023

Mortgage Credit Availability Mostly Flat In July

Have Home Prices Already Seen Their Bottom?

When mortgage rates started to increase last year, there was fear that home prices might soon crash. The expectation was that buyers would retreat and declining demand would cause values to tumble. That fear, though, seems to have been unfounded. There were declines, of course – in some locations more than others – but prices overall held steady and even began climbing again earlier this year. But can we say for sure that home prices bottomed? According to one recent analysis, it looks that way but may be too soon to say. The lack of available homes for sale combined with continuing demand from buyers has largely kept prices afloat. That dynamic doesn’t seem likely to change in the near future. However, the analysis makes clear that mortgage rates have remained high and continue to cause affordability challenges for home buyers. Where affordability heads from here will determine whether or not prices adjust somewhere down the line. (source)

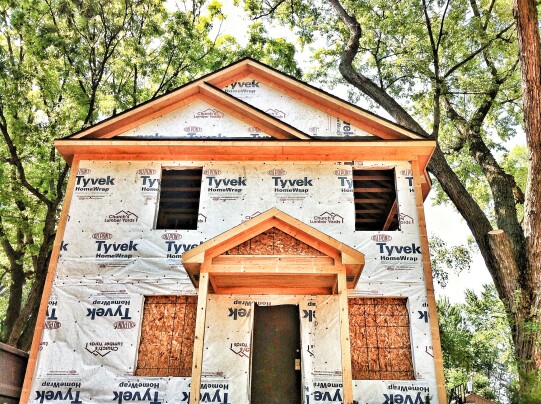

Construction of New Homes Sees Summer Surge

When there are too few homes for sale, the quickest solution is to build more homes. New home construction offers buyers more options and helps alleviate upward pressure on prices of existing homes. In other words, it’s exactly what the housing market needs right now, since the inventory of homes for sale remains well below its pre-pandemic norm. Fortunately, according to new numbers from the U.S. Census Bureau and the Department of Housing and Urban Development, it looks like home builders are on the case. In fact, new residential construction statistics show the number of new, single-family homes that began construction in July was 6.7 percent higher than the month before. That’s a significant mid-summer surge and an encouraging sign for shoppers of both new and existing homes. It also puts single-family housing starts nearly 10 percent above where they were last year at the same time. Regionally, the data shows home building strongest in the West and Midwest, with the Northeast and South both seeing month-over-month declines. (source)

Demand Holds Steady As Mortgage Rates Rise

According to the Mortgage Bankers Association’s Weekly Applications Survey, average mortgage rates moved higher last week for 30-year fixed-rate loans with both conforming and jumbo balances. Rates were also up for 15-year fixed-rate mortgages, though they fell for FHA loans and 5/1 ARMs. Joel Kan, MBA’s vice president and deputy chief economist, says the economy has been resilient and it’s pushing rates upward. “Treasury rates were elevated again last week following mixed data on inflation and more indication of resiliency in the economy, which may pose a challenge to the Federal Reserve’s efforts to lower inflation,” Kan said. Still, despite higher rates, demand for loans to buy homes was flat from the week before and there was a 2.4 percent week-over-week increase in government purchase applications, as demand for both FHA and VA loans rose. The ARM share of applications was also up, hitting its highest level since April. The MBA’s weekly survey has been conducted since 1990 and covers 75 percent of all retail residential mortgage applications. (source)

Home Builder Confidence Dips In August

The National Association of Home Builders’ Housing Market Index is based on a monthly survey of builders. The index gauges builders’ confidence in the new home market using a scale where any number above 50 indicates more builders view current conditions as good than poor. In August, the index fell to 50, six points lower than the previous month. Alicia Huey, NAHB’s chairman, says builder sentiment declined but demand for new homes remains strong. “While this latest confidence reading is a reminder that housing affordability is an ongoing challenge, demand for new construction continues to be supported by a lack of resale inventory, as many homeowners elect to stay put because they are locked in at a low mortgage rate,” Huey said. The survey found a rising number of home builders countering higher costs by offering incentives to buyers. In fact, 25 percent of survey respondents reported reducing prices to bolster sales. (source)

How Many Homes Are Worth $1 Million?

For most of the past decade, home prices have been rising steadily. A historically low number of homes for sale matched with historically low mortgage rates caused an imbalance in the housing market. Particularly during the pandemic, low rates pushed home buyer demand higher and the competition for available homes led to skyrocketing prices. For home buyers, years of surging home prices can make it feel like every house must now cost $1 million or more. But how many million dollar houses are there really? Well, one recent analysis crunched the numbers and, though the number of million dollar homes has definitely jumped since the pandemic, it’s beginning to cool off. In fact, the share of single-family homes worth more than $1 million fell from an all-time high of 8.6 percent one year ago down to 8 percent now. In 41 of the 99 most populous metro areas, the number of million-dollar homes has fallen and, in the 55 metros where it’s risen, the increase was less than one percent. Whether the trend continues is anyone’s guess but, for now at least, the number of million dollar homes is actually on the decline. (source)

Buyers To Benefit From Late Summer Slowdown

The housing market has a pattern and it’s fairly easy to spot. It follows the seasons. Things start heating up in the spring and early summer, then begin to cool off beginning around September. Fall and winter are typically slower, with fewer homes to buy and fewer buyers active in the market. Of course, just like the seasons, sometimes things veer off track and we’ll have an unusually hot winter market or a cool summer, with slower sales and less competition. Generally speaking, though, the housing market has its pattern. This year looks to be no different. In fact, according to one report, the market is already showing signs of a late-summer slowdown. For one, price increases have slowed. From June to July, the typical home climbed 0.9 percent, after rising 1.4 percent the previous two months. Homes are also spending a little longer on the market, with the typical home going under contract two days later than it did in April and May. A combination of lower prices and less competition is good news for home buyers looking to make a move in the months ahead. But while there are encouraging signs, buyers still need to be prepared. Active inventory remains 44 percent below 2019 levels. (source)