Fannie Mae’s Economic and Strategic Research Group releases a forecast each month covering their predictions for the economy and housing market. According to their most recent release, their outlook for full-year economic growth has been revised upward from last month’s projection. Their home-sales growth projection was also revised upward based on an expected end-of-year sales surge. But while the year-end forecasts were increasingly positive, the group sees challenges ahead in 2022. For one, they expect fewer home sales next year due to limited for-sale listings and growing affordability constraints. “According to the ESR Group, the impact of monetary policy tightening to combat inflation will combine with ongoing supply issues and still appreciating home prices to slow sales activity,” the release says. “While the economy picked up steam late in the year, unfortunately, so did inflation, and the market expects the Fed to recalibrate its monetary policy as a result.” Part of that is an expected mortgage rate increase. But while the Fed is likely to raise rates in 2022, they will still remain low by historical standards. (source)

Archive for December 2021

Credit Availability Unchanged in November

When thinking about buying a house, most of us look at home prices and mortgage rates. Together, they can provide a rough idea of how much home we can afford. They aren’t, however, the only factors that determine whether or not we’re ready and able to buy. One metric that isn’t as commonly checked but has a significant impact is mortgage credit availability. Put simply, the standards lenders use to determine whether or not a borrower is qualified aren’t fixed. That means, there are times when it’s easier to qualify for a mortgage and times when it’s more difficult. The Mortgage Bankers Association tracks credit availability each month to gauge whether standards are loosening or tightening. Any increase indicates lending standards are loosening, while a decrease means they’ve tightened. In November, the index was relatively flat, falling less than 1 percent from the month before. Joel Kan, MBA’s associate vice president of economic and industry forecasting, says government credit tightened while other loan types loosened. “The picture was different depending on the market segment,” Kan said. “An increase in conventional credit availability was offset by a decrease in government credit, as lenders reduced their offerings of government loan programs with lower credit scores, as well as those for investment homes.” (source)

Home Builders Feeling Confident At Year’s End

The National Association of Home Builders’ Housing Market Index measures builder confidence in the market for newly built single-family homes. It is an important indicator of housing market health because, when builders are optimistic and building more homes, it helps balance supply and demand, gives buyers more options to choose from, and helps moderate price increases. This is especially true when the inventory of homes available for sale is low, as it has been this year. In December, the NAHB’s survey – which is scored on a scale where any number above 50 indicates more builders view conditions as good than poor – hit 84, matching this year’s highest reading. Robert Dietz, NAHB’s chief economist, says lack of inventory continues to be the market’s biggest challenge. “The most pressing issue for the housing sector remains lack of inventory,” Dietz said. “Building has increased but the industry faces constraints, namely cost/availability of materials, labor, and lots.” Despite those challenges, all three of the indexes components scored well above 50 in December, including the gauge of current sales conditions which rose to 90. (source)

Purchase Loan Demand Rises Week Over Week

According to the Mortgage Bankers Association’s Weekly Applications Survey, demand for loans to buy homes rose 1 percent last week from the week before. The improvement included a nearly 2 percent increase in demand for conventional loan applications. Despite the increase, however, overall demand was down 4 percent due to a 6 percent decline in refinance activity. Joel Kan, MBA’s associate vice president of economic and industry forecasting, says loan balances remain high. “The strength in conventional purchase activity continues to support higher loan balances, which moved back over $400,000,” Kan said. “Housing demand remains strong as the year comes to an end amidst tight inventory and steep home-price growth.” Also in the report, average mortgage rates were relatively flat from one week earlier, with interest rates for 30-year fixed-rate mortgages with conforming loan balances unchanged from the week before. The MBA’s weekly survey has been conducted since 1990 and covers 75 percent of all retail residential mortgage applications. (source)

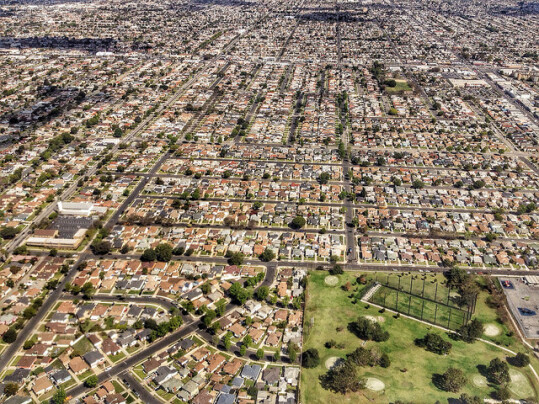

Where Are Most New Homes Being Built?

You can tell a lot about your local housing market by paying attention to where new homes are being built. Home builders don’t build in areas people don’t want to live. So the locations with the most building activity are likely the most desirable to home buyers. During the early days of the pandemic, there was a shift in buying patterns that led more Americans to search for homes further away from city centers. That suburban shift was well documented and, according to a new analysis from the National Association of Home Builders, has continued through 2021. In short, new-home construction is still growing fastest in the suburbs and exurbs. But as things have gotten back to normal and more remote workers have returned to the office, there’s also been a return of single-family home building in high-density markets. For example, in 2020, home building in exurbs grew at twice the rate it did in large metro areas. This year, the gap between the two has narrowed significantly. What does this mean? Well, it means more Americans are looking to buy near big cities and, if you’re among them, you likely find more new homes available for sale. (source)

Remote Work Continues To Impact Buying Decisions

Work has a big impact on how and where we live. It determines what we can afford and where we need to be on a day-to-day basis. So when the pandemic began and more Americans started working remotely, it also led to some significant changes in home buying patterns. Where buyers previously valued proximity to their jobs and a short commute, they now were placing more importance on space, affordability, and proximity to family and friends. In short, more freedom to work from anywhere meant more freedom to live anywhere. But, according to the National Association of Realtors’ chief economist, Lawrence Yun, it’s too soon to say whether those patterns are here to stay. “We are only in the first innings of work-from-home options,” Yun said. “People have not fully digested the work-from-home flexibility model yet in determining home size and locational choice.” It’s true. With many workplaces still weighing whether their employees should come back to the office full time, have a hybrid schedule, or stay totally remote, there are many Americans who are waiting to see what options they have. As those decisions get made and become permanent, it’ll impact where and what home buyers are looking for in their next home. (source)

Homeowners Continue To See Big Equity Gains

Some of homeownership’s benefits are constant. Stability and the freedom to customize your living space, for example. Others depend a lot upon the ups and downs of the market. Equity is one of them. And these days, because of the market’s continuing strength, homeowners are reaping the benefits in a big way. In fact, according to Black Knight Financial’s most recent Mortgage Monitor, surging home values have increased the average mortgage holder’s equity stake by $53,000, for an average of more than $175,000 in available equity per homeowner. Ben Graboske, Black Knight’s president, says the gains are astonishing. “Home price growth in the third quarter – while less than half that of Q2’s history-making rate – added more than $250 billion to Americans’ already record levels of tappable equity,” Graboske said. “The aggregate total of $9.4 trillion is up an astonishing 32 percent from the same time last year and nearly 90 percent higher than the pre-Great Recession peak in 2006.” Increasing equity has also driven the average homeowner’s loan-to-value ratio to the lowest level on record, meaning their home’s value now far exceeds the amount they owe on it. (source)