How are Americans feeling about the real estate market this summer? Well, according to Fannie Mae’s monthly Home Purchase Sentiment Index, as good as ever. The index – which measures consumers’ attitudes about home prices, buying and selling, mortgage rates, etc. – found overall sentiment up in June, even matching February’s all-time high. Doug Duncan, Fannie Mae’s senior vice president and chief economist, said Americans are feeling optimistic overall but particularly about selling a house. “The June HPSI reading matches the previous record set in February and reflects the trend toward a sellers’ market that respondents indicated last month,” Duncan said. “Consumers are also growing more optimistic about their ability to get a mortgage, and lenders expect credit standards to ease further going forward, as shown in our Mortgage Lender Sentiment Survey.” But despite the good news, Duncan warns that, with fewer homes for sale this season, easing credit standards could have the unintended consequence of pushing home prices higher. Still, even with the challenges today’s market presents, buyers remain eager. In fact, the number of respondents who said now was a good time to buy a house was up 3 percent in June. More here.

Archive for July 2017

Home Buyers Return Despite Higher Rates

According to the Mortgage Bankers Association’s Weekly Applications Survey, average mortgage rates moved up last week across all loan categories, including 15-year fixed-rate loans, loans backed by the Federal Housing Administration, and 30-year fixed-rate loans with both jumbo and conforming balances. The rate increase was the sharpest in months and put rates at their highest level since May. Joel Kan, an MBA economist, told CNBC the rate increase was due to economic gains in Europe. “The 30-year fixed mortgage rate increased to its highest level since May 2017, following a jump in the U.S. 10-year Treasury which was driven mainly by news that European economies have strengthened and the ECB may be poised to tighten its accommodative policies,” Kan said. Whatever the case, home buyers weren’t phased by the bump in rates. In fact, demand for loans to buy homes was up 3 percent from one week earlier and is now 6 percent higher than at the same time last year. The MBA’s weekly survey has been conducted since 1990 and covers 75 percent of all retail residential mortgage applications. More here.

Vacation Home List Ranks Best Markets For Buyers

Buying a vacation home is something many Americans dream of doing one day but many more think is out of reach. After all, isn’t having a second home only for the rich, famous, and lucky? Well, according to a new report from ATTOM Data Solutions, you may not have to have millions of dollars in order to own your own getaway home. The report ranks the nation’s top 100 cities where at least one in every 12 buyers is looking for a second home. They then took those areas and looked at air quality, summertime temperatures, crime, home appreciation, and prices to determine the best markets for buyers. The results show four states dominating the top 10 and all have homes with a median price below $275,000. Crossville, Tenn., tops the list with cities in North Carolina, Florida, and Maryland rounding out the ten best markets with affordable prices. If, however, you have some money to spend, California’s La Jolla, Santa Barbara, and Laguna Niguel are among the top high-end markets. Boulder, Colo. And Marco Island, Fla., are also among the top five markets with median prices above a half million dollars. More here.

Mortgage Lenders Say Credit Standards Are Easing

One of the main obstacles potential home buyers face is the fear that they won’t be approved for a mortgage. Believing that you don’t make enough, have too much debt, or can’t afford to buy a house is one reason many people don’t even bother to get in touch with their lender to explore their financing options. If you’re someone who wants to buy a house, but thinks they won’t make the cut, Fannie Mae’s quarterly Mortgage Lender Sentiment Survey has some good news for you. According to the results of the survey – which asks senior executives at lending institutions across the country for their perspective on whether mortgage lending standards are getting tighter or are loosening – found the share of lenders who say they have eased credit standards over the prior three months has been rising since the end of last year and the number that say they expect to ease them further in the coming three months has now reached or surpassed survey highs. There are a number of reasons why mortgage lenders may be making it easier for buyers to gain access to credit but, among the top reasons cited, concern about economic conditions was high on the list. More here.

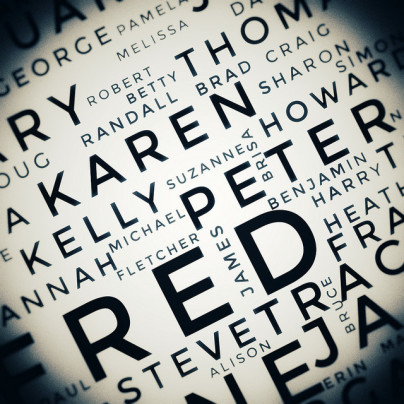

What Your Name Says About The Home You Buy

For the most part, people stick with the name their parents gave them and don’t ever give it too much thought. Sure, you’ve got the power to change it to just about anything you want but, unless you’re stuck with something horrible, why would you go through the bother? After all, your name doesn’t determine much of anything beyond what people call you, right? Well, according to new data from Zillow, your name may have something to do with the house you buy. For example, homeowners with the names Stuart and Alison own the most valuable homes in the country, with a median price of more than $330,000. Of course, there is no real correlation between your name and the price of the home you own but, if your name is Peter, Alexandra, or Geoffrey, you may be more likely to own a more valuable home than most. Also, if you’re a woman. Though the number of homeowners is pretty equally split between the two genders, in 30 of the 46 analyzed states homeowners with traditionally female first names owned more expensive homes than their male counterparts. But what does this all mean for homeowners and home buyers? Not much, but it does say something about the diverse backgrounds of homeowners across the country. More here.