A new survey of home builders finds confidence in the new home market high, despite being relatively unchanged from the month before. The National Association of Home Builders Housing Market Index measures builders’ confidence on a scale where any number above 50 indicates that more builders view conditions as good than poor. In January, the Index declined one point to 57, after December’s reading was revised upward from 57 to 58. David Crowe, NAHB’s chief economist, said January’s reading is in line with the organization’s forecast heading into the new year. “Steady economic growth, rising consumer confidence and a growing labor market will help the housing market continue to move forward in 2015,” Crowe said. Among the index’s three components, those measuring expectations for future new home sales and traffic of prospective buyers both fell, while the component gauging current conditions was unchanged. Regionally, the West, Midwest, and Northeast all saw gains from the month before, while the South slipped two points. More here.

Archive for January 2015

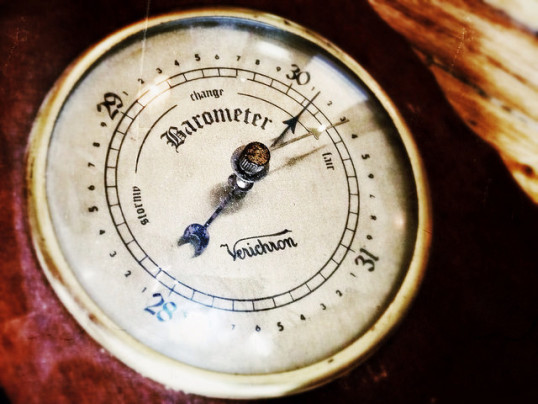

Has The Housing Market Returned To Normal?

Trulia’s Housing Barometer is a measure of how quickly the housing market has been returning to normal following the economic crisis and housing crash. The Barometer looks at five economic indicators, including existing home sales, home prices, delinquency and foreclosure rates, new residential construction, and the employment rate for young adults. Based on a comparison of where things are now as compared to their lowest point and their last normal period, the Barometer determines how far the housing recovery has come. Over the past year, all five indicators have improved significantly. In fact, three of the five are more than three-quarters back to normal. New construction and employment among young Americans are the only two categories that are still lagging behind. And, according to the most recent release, employment has improved rapidly, rising from 26 percent back to normal in 2013 to 46 percent back to normal last year. Housing starts, though improved from a year earlier, didn’t gain as much ground and remain just 53 percent back to normal. Still, the overall improvement is encouraging news and bodes well for the economy and housing market over the coming months. More here.

Foreclosure Filings Fall To 8-Year Low

In 2014, foreclosure filings – which include default notices, scheduled auctions, and bank repossessions – fell to their lowest annual level since 2006, according to RealtyTrac. That’s a 61 percent improvement since 2010, when they peaked at nearly 3 million for the year. Daren Blomquist, RealtyTrac’s vice president, said last year’s foreclosure numbers indicate that the market is close to finding a floor and stabilizing at a historically normal level. And though there’s been a recent uptick in the number of foreclosure starts on a month-to-month basis, analysts say it isn’t cause for concern. The regions that are seeing an increase in foreclosure activity are the same areas that still have a backlog due to processing problems. In other words, the number of distressed mortgages is not increasing despite the spike in activity. That means, the overall downward trend continues. In fact, RealtyTrac’s report found just one in every 118 housing units had at least one foreclosure filing in 2014, which is the first time since 2006 that the annual foreclosure rate has been below 1 percent of all housing units. More here.

Mortgage Demand Surges As Rates Fall Again

According to the Mortgage Bankers Association’s Weekly Applications Survey, average mortgage rates fell to their lowest level since May 2013 last week, sending demand for mortgage applications soaring. In fact, the Market Composite Index – which measures total mortgage loan application volume – was up 49.1 percent from the week before, the largest weekly gain since 2008. Mike Fratantoni, MBA’s chief economist, said the economy and job market continue to show signs of strength, but weakness abroad and falling oil prices have led to continued declines in long-term interest rates. In addition to positive economic news and historically low rates, Fratantoni said prospective home buyers also benefit from recent evidence that credit is becoming more available and news that the FHA is lowering mortgage insurance premiums. Last week, average mortgage rates fell across all loan categories, including 30-year fixed-rate loans with both conforming and jumbo balances, FHA-backed loans, and 15-year fixed-rate mortgages. The drop led to a doubling of refinance activity and a 24 percent increase in purchase demand. The MBA’s weekly survey has been conducted since 1990 and covers 75 percent of all retail residential mortgage applications. More here.

Rent Rises At Twice The Pace Of Income

If you think renting is cheaper than buying a house, think again. Recent data shows that, in most markets, buying a home is actually more affordable than renting. And, according to new numbers from Zillow, rent isn’t getting any cheaper. In fact, there were 770,000 new renters last year and a cumulative total of $441 billion spent in rent. That’s up 4.9 percent from the year before and analysts believe rental affordability will continue to decline in 2015. Stan Humphries, Zillow’s chief economist, says rent has grown at twice the pace of income over the past 14 years. “This has created real opportunities for rental housing owners and investors, but has also been a bitter pill to swallow for tenants, particularly those on an entry-level salary and those would-be buyers struggling to save for a down payment on a home of their own,” Humphries said. With rent expected to rise again this year and home prices continuing to stabilize after spiking in 2013, buying a home should continue to be a more affordable option than renting in most markets over the coming year. More here.

Homeowners’ Equity Hits 8-Year High

Homeowners’ equity refers to the total value of a property minus the amount of mortgage debt still owed. And, according to the most recent Housing Scorecard from the U.S. Department of Housing and Urban Development, it’s on the rise. In fact, during the third quarter of last year, equity rose nearly $168 billion from the previous quarter and reached its highest level since the second quarter of 2007. That’s good news for homeowners and a big improvement from where it was just a few years ago. The data is among many positive indicators found in the monthly report, which collects key housing information and details of the administration’s foreclosure prevention efforts. The Scorecard also lists stabilizing home prices, downward trending foreclosures completions, and the success of government mortgage modification and assistance programs among the housing market’s continued gains. However, the report also notes that new home sales slowed in November, as did sales of previously owned homes. It also cautions that there is still room for further improvement and a need to continue recovery efforts. More here.

Foot Traffic Swells In December

Each month, the National Association of Realtors receives data on the number of properties shown by Realtors during the month. Referred to as foot traffic, the number of people that are actively shopping to buy a house is generally a good indicator of future home sales. After all, the more people looking at homes, the more homes will sell. In December, the amount of foot traffic spiked, finishing at the second highest level of the year. The improvement coincides with a number of positive end-of-the-year economic reports and is a significant rebound following the previous month’s downturn. It also bodes well for the spring selling season. Increased interest among potential home buyers combined with historically low mortgage rates and a stronger job market should help boost home sales as the housing market’s busiest season begins. The data also matches the optimistic outlook of many industry analysts who say this year should be better for residential real estate as the market continues to stabilize and Americans gain confidence in the economy, their personal financial situation, and their local housing market. More here.